Silicon Carbide Industry Trends in 2025

2025-01-07 08:29

As one of the representative materials of wide bandgap semiconductors, silicon carbide (SiC) has accelerated its penetration into more fields in the past 2024. Stimulated by cost reduction and efficiency improvement, the global silicon carbide industry maintained a wave of "capital increase and expansion" in 2024. Related companies in the industrial chain competed to make new moves, actively expanded production capacity, and promoted the industrialization process of silicon carbide to move forward.

Against this background, in 2025, the silicon carbide industry will officially enter the critical stage of 8-inch capacity conversion; at the same time, companies will also face greater competitive pressure and new challenges in the process of welcoming the accelerated implementation of industrialization.

Large manufacturers bet on "large size"

Silicon carbide companies are moving towards 8-inch wafers and substrates.

In order to seize more market share in electric vehicles, industry, energy and other fields, international manufacturers such as STMicroelectronics and ON Semiconductor have invested heavily in building new 8-inch factories to expand silicon carbide production capacity.

In May 2024, STMicroelectronics announced that it would build a large-scale manufacturing and packaging and testing integrated base for 8-inch silicon carbide power devices and modules in Catania, Italy, which is also the world's first full-process vertically integrated silicon carbide factory. The total investment of the project is expected to be 5 billion euros, and it is expected to be put into operation in 2026 and reach full production capacity by 2033. With this project, STMicroelectronics will realize its ambition of fully vertically integrating silicon carbide manufacturing-complete the production of silicon carbide power devices from chip research and development to manufacturing, from wafer substrates to modules in one park, enabling the electrification process and high-efficiency transformation of automotive and industrial customers.

In June of the same year, ON Semiconductor announced that it would invest $2 billion to build a vertically integrated silicon carbide manufacturing plant in the Czech Republic to expand its silicon carbide production capacity. In December, ON Semiconductor announced that it had reached an agreement with Qorvo to acquire the silicon carbide junction field effect transistor (SiC JFET) technology business and Qorvo subsidiary United Silicon Carbide for $115 million in cash. ON Semiconductor said the move will accelerate ON Semiconductor's preparation for emerging markets such as electric vehicle battery disconnects and solid-state circuit breakers.

In August, Infineon officially launched the first phase of the Kulin SiC wafer plant, which will help Infineon achieve its goal of occupying 30% of the global SiC market share by 2030.

In addition, it has been reported recently that German automotive parts supplier Bosch has reached a preliminary agreement with the US Department of Commerce and plans to invest $1.9 billion to transform the Roseville manufacturing facility in California into a semiconductor factory for the production of 8-inch SiC chips.

Although Japan still occupies a pivotal position in the field of power semiconductors, it has also faced challenges brought about by market and industry changes in recent years. For this reason, "anxious" Japanese power semiconductor manufacturers have increased investment and expanded production in 2024 to strengthen their SiC supply chain.

In July 2024, Japan's Rohm Semiconductor, through its subsidiary Lapis Semiconductor, reached a basic agreement with Solar Frontier to acquire the assets of its Kunitomi plant and transform the plant into an 8-inch SiC wafer manufacturing plant. In September of the same year, Sumitomo Metal and its wholly-owned subsidiary Sicoxs Coparation announced that they would build a new 8-inch SiCkrest (direct bonding substrate manufacturing technology developed by Sicoxs) mass production line at Sicoxs' Ohkuchi plant. Another Japanese company, Fuji Electric, announced that it would invest 200 billion yen in silicon carbide power semiconductor production in fiscal 2024-2026, including 8-inch SiC production capacity at its Matsumoto plant in Japan, which is expected to start production in 2027.

It is worth noting that my country is also catching up in 8-inch wafer manufacturing. In April 2024, the 8-inch silicon carbide engineering wafer of Xinlian Integrated was successfully put into production, becoming the first wafer factory in China to start 8-inch silicon carbide production, and plans to enter mass production in 2025.

Industry insiders pointed out that the shift from 6-inch to 8-inch silicon carbide is an inevitable trend, and 8-inch mass production will help silicon carbide products move towards large-scale application.

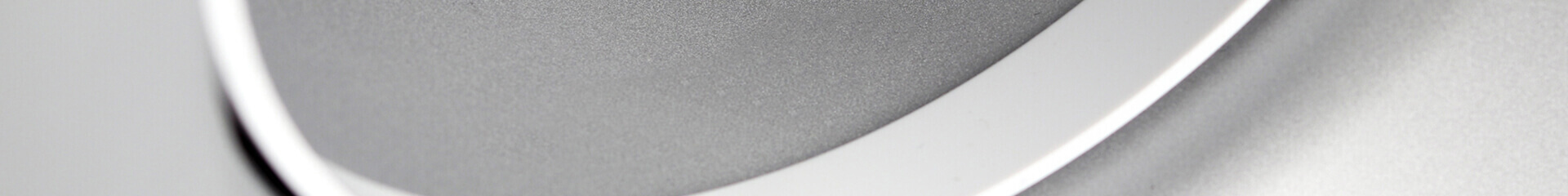

Silicon carbide substrate production capacity "greatly improved"

From the perspective of the industrial chain, the main challenge facing silicon carbide at the time of upgrading and shifting gears is on the substrate end. Due to the high technical and financial barriers of silicon carbide substrates, substrate production capacity affects the development pace of the silicon carbide industry. In recent years, my country's silicon carbide substrate industry has developed rapidly and has become an important global production base.

In 2024, silicon carbide substrate-related companies actively deployed capacity expansion, and more projects entered the implementation stage or made progress.

Get the latest price? We'll respond as soon as possible(within 12 hours)